As we drive into 2024, understanding the intricacies of mileage reimbursement is crucial for both employers and employees. Whether you’re a business owner looking to compensate your employees fairly or a worker seeking to understand your entitlements, this guide will cover all aspects of mileage reimbursement in 2024.

Key Takeaways

- Mileage reimbursement rates are influenced by various factors, including fuel prices, vehicle maintenance costs, and economic conditions.

- Accurate record-keeping and understanding IRS guidelines are essential for compliance.

- Employers should consider flexible reimbursement policies to accommodate different employee needs.

Understanding Mileage Reimbursement

Mileage reimbursement is a common practice where employers compensate employees for the use of their personal vehicles for work-related travel. This compensation covers the costs associated with fuel, maintenance, and depreciation of the vehicle. The IRS typically sets a standard mileage rate annually, which serves as a guideline for businesses.

Why Mileage Reimbursement Matters

For employees, mileage reimbursement ensures that out-of-pocket expenses incurred during work-related travel are adequately covered. For employers, it is a way to maintain transparency and fairness in compensating employees, which can enhance job satisfaction and productivity.

Mileage Reimbursement Rates for 2024

While the IRS has yet to release the official mileage reimbursement rate for 2024, it is expected to reflect current economic conditions, including fluctuations in fuel prices and vehicle maintenance costs. Historically, the rate has been adjusted annually to align with these factors.

Factors Influencing Mileage Reimbursement Rates

- Fuel Prices: The cost of gasoline is a significant determinant of the mileage rate. As fuel prices rise, so does the reimbursement rate.

- Vehicle Maintenance: Regular maintenance costs, such as oil changes and tire replacements, contribute to the overall calculation of the mileage rate.

- Economic Conditions: Inflation and other economic factors can impact the rate set by the IRS.

How to Calculate Mileage Reimbursement

Calculating mileage reimbursement is straightforward. Multiply the total miles driven for work purposes by the IRS standard mileage rate. For example, if the rate is 60 cents per mile and an employee drives 100 miles, the reimbursement would be $60.

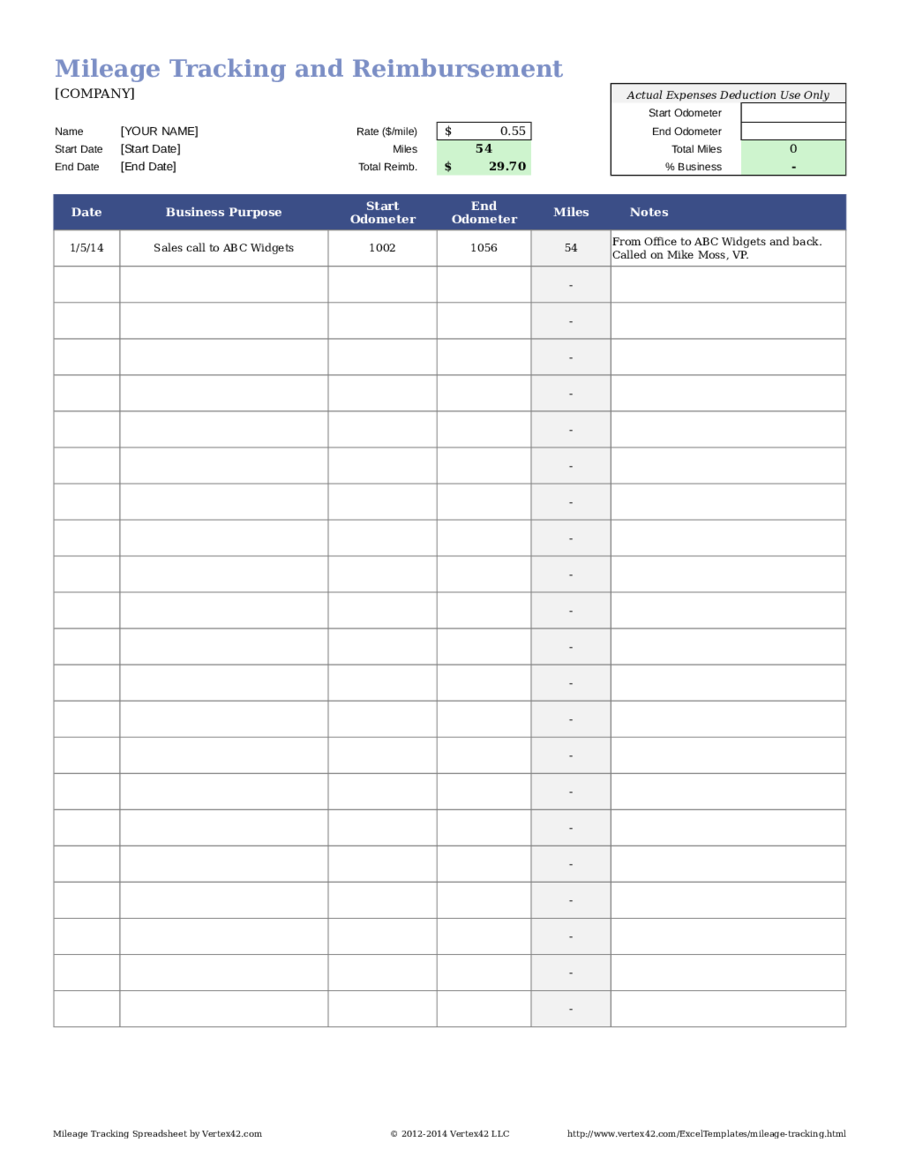

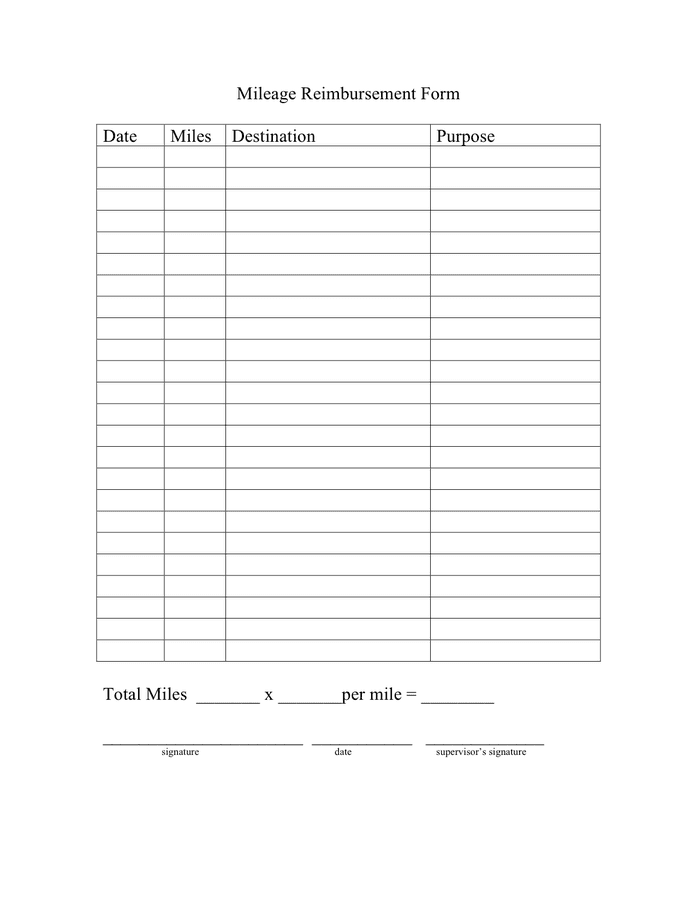

Record-Keeping for Mileage Reimbursement

Accurate record-keeping is essential for both employees and employers. Employees should maintain a detailed log of their mileage, including the date, purpose of the trip, starting and ending locations, and total miles driven. Employers should verify these records to ensure compliance with IRS guidelines.

IRS Guidelines and Compliance

The IRS provides specific guidelines for mileage reimbursement to ensure that both employers and employees comply with tax regulations. It is crucial to adhere to these guidelines to avoid potential tax liabilities.

Tax Implications

Mileage reimbursement is generally not considered taxable income, provided it does not exceed the IRS standard rate. However, any excess reimbursement may be subject to taxation. Employers should ensure that their reimbursement policies align with IRS standards to avoid complications.

Best Practices for Employers

Employers should consider implementing flexible mileage reimbursement policies that accommodate different employee needs. This can include offering alternatives such as company cars or fuel cards for employees who travel extensively.

Technology and Tools

Leveraging technology can streamline the mileage reimbursement process. Mobile apps and software solutions can help employees track their mileage accurately and submit reimbursement requests efficiently. These tools can also assist employers in managing and verifying mileage logs.

Looking Ahead: Mileage Reimbursement Trends in 2024

As we move into 2024, several trends are expected to shape the landscape of mileage reimbursement. With the rise of remote work and hybrid models, companies may need to reassess their reimbursement policies to accommodate changing work dynamics.

Sustainability and Mileage Reimbursement

Sustainability is becoming a key consideration for businesses. Companies may encourage employees to use eco-friendly vehicles or public transportation by offering incentives or adjusted reimbursement rates.

Understanding mileage reimbursement in 2024 is essential for both employers and employees to ensure fair compensation and compliance with IRS guidelines. By staying informed about the latest rates, maintaining accurate records, and adopting flexible policies, businesses can navigate the complexities of mileage reimbursement effectively.

As the year unfolds, keeping an eye on economic trends and IRS announcements will be crucial for making informed decisions regarding mileage reimbursement. Whether you’re an employer or an employee, being proactive and informed will help you stay on the right track.